Earnings reports have a unique ability to send shockwaves through the stock market.

Whether a company exceeds expectations or falls short, the market reacts swiftly and often dramatically. This volatility can be both a blessing and a curse for investors.

Even reputable companies may go through periods of sell-offs when their earnings reports fail to meet analysts' and investors' expectations.

However, when it comes to these high-quality stocks, this could present an excellent opportunity to consider selling cash secured put options.

Remember the timeless adage: "Be greedy when others are fearful."

Avoid Selling Puts Before Earnings Reports

A very important rule to remember when thinking about selling puts is to avoid doing it right before a company releases its earnings report.

The reason is simple: the uncertainty surrounding these reports can lead to unpredictable stock price movements.

Back when I began selling options in 2018, I made a significant mistake by not sticking to this specific rule.

What made it even worse was that I wasn't prepared to own the stock, so when its price unexpectedly fell, I was caught completely off guard and unprepared.

Instead, it's wise to wait until after the earnings dust has settled to evaluate your options.

Real World Example

On September 12, 2023, Oracle Corporation (ORCL) experienced a sudden and significant

Then, on September 15, 2023, Adobe Inc. (ADBE) also saw a 5% decline in its stock price following its earnings report, even though it had a pretty decent quarter.

Both of these companies have strong fundamentals, but from time to time, there are various external factors can affect their stock prices.

Implied Volatility and Patience

After a stock crash, implied volatility tends to increase significantly. While this might seem like an ideal time to sell puts, it's essential to exercise caution.

Two critical factors come into play:

1. Option Chain Consolidation: In the immediate aftermath of a stock crash, the bid-ask spread for options chain will be very wide and it might be difficult to get fills. Prices may not reflect the new reality, making it challenging to make informed decisions.

2. Potential Continued Sell-Off: It's not uncommon for the sell-off to extend into the following trading day. Rushing to sell puts during this period can expose you to additional risks.

Given the factors mentioned above, it's a smart choice to consider selling put options only within 1-3 days following the earnings report.

Enhance Margin of Safety

Selling put options on high-quality stocks when they encounter short-term headwind is attractive due to the enhance margin of safety.

Imagine this scenario: a stock has already declined by 5-10% from its recent trading price. Thanks to the higher implied volatility, you can sell far out of the money (OTM) options with a low probability of being exercised and still receive attractive premiums. As a result, you usually establish an added safety margin of 5-10% below the market price.

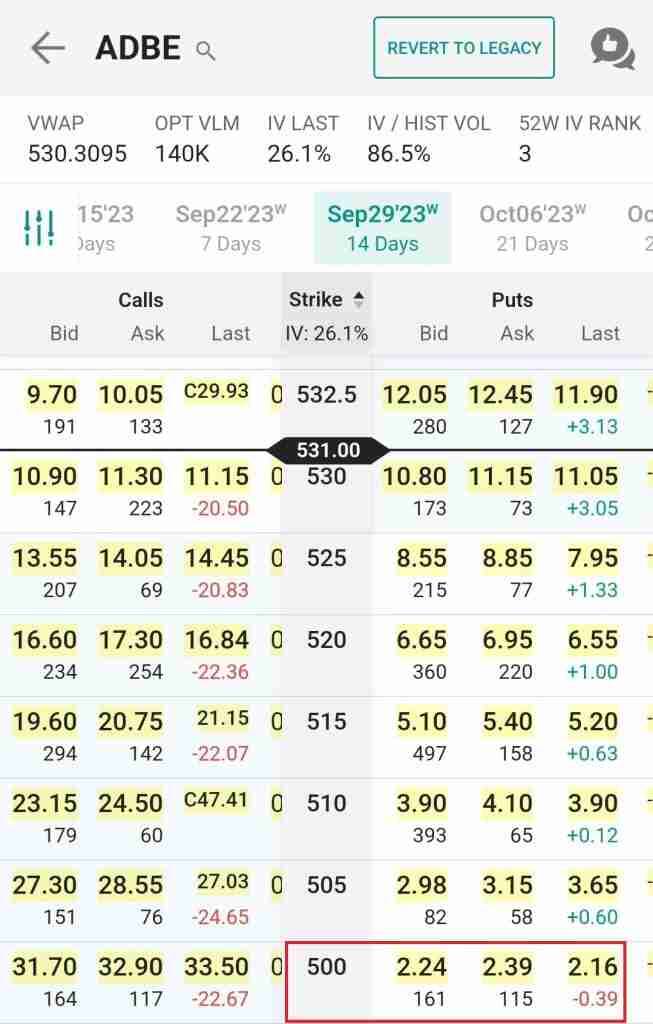

Returning to the Adobe example, on the day of the earnings release, the stock was down 5% at one point. Potential investors have the opportunity to sell an option with a strike price of $500, expiring in two weeks.

This strike price was approximately $30 or around 5.6% below the current market price, providing a huge margin of safety. In addition, the person selling the put option could expect to receive approximately $230 in premiums (excluding fees) which is remarkable for a low delta position.

Conclusion

Selling cash-secured puts after a stock crash can be a smart move for investors who want to buy good stocks on sale.

But to do it right, you should remember a few important rules - Don't sell these puts right before a company releases its earnings report, and be patient when the stock market is consolidating when volatility is at its peak.

By following these guidelines, investors can potentially reap the rewards from selling puts at the right time. If the put position expires worthless, you get to pocket attractive premiums.

If the position is assigned, you have the opportunity to buy high-quality stocks at a substantial discount. It's truly a win-win situation.

Add comment

Comments